Odds are, trailer insurance isn’t at the top of your priority list. In fact, maybe you didn’t even know it existed before now. Trust us, you’re not alone. But don’t worry; we’re here to help you figure out whether or not trailer insurance is the right choice for you.

And since some states do require that you have cargo trailer insurance, it’s best to know what you’ll be looking at should the time come.

First up, is trailer insurance important?

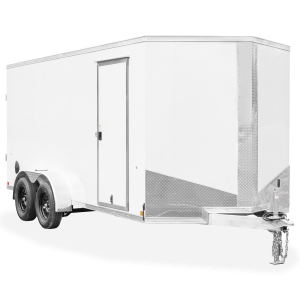

We all know the road can bring many difficulties a driver’s way… and that’s without ever having a trailer hitched up. So, add the typical hazards—hilly terrain, human error, potholes, speed bumps, wind, and unpredictable weather with the added weight and length of an enclosed trailer—and you’ve got a recipe for potential damage.

Now, if you haven’t upgraded your trailer in a while (hey look, here are some options!), trailer insurance may not be something you need to hassle with. At least not full coverage. The same goes for the type of cargo you’re hauling around. If it’s all pretty replaceable, the cost of insurance may not make sense for you. But again, some states require it no matter what.

What’s all included with typical trailer insurance?

Depending on which provider you choose (and there are plenty offering), you’ll find that trailer insurance covers everything from water damage to theft. Damage incurred from graffiti can also be covered if that’s what you’re in need of (and we hope you don’t!).

This brings us to the type of insurance policy you may need. To protect more than just yourself and your trailer in the event of an accident (unhitching in transit, for example), you’ll want liability in case anyone (or thing) is involved. And, if you’re hauling classic cars or one-of-a-kind heirlooms, you may want to go with full coverage: collision and comprehensive. This will offer you the best protection for your assets. But, as always, speak to your insurance rep and they’ll guide you towards the right policy for your situation.

Any restrictions?

If you’re using the enclosed trailer for anything other than hauling (living, concessions, etc.), then you may be ineligible. There are a few reasons you may not be covered, including length restrictions, trailer value, and others.

How much am I looking at?

These numbers can vary depending on your location, the type of wear and tear you expect with the trailer, the kind of cargo you’re towing, the trailer’s size, and whether or not the trailer is attached to your auto policy. That last one could be the difference between damage incurred during transit and something happening while it’s parked at home without the tow vehicle.

Where can I get trailer insurance?

There’s no shortage of insurance agencies that provide trailer insurance—whether it’s for closed trailers, car trailers, snowmobile trailers. If you’re already using a major insurance company—you know, the one with the gecko or the team with the white aprons—you can probably attach your trailer’s insurance to the existing policy. Or, you could always go the independent agency route, whatever makes the most sense for you and your pocketbook.

Plus, depending on the size of your trailer, your auto policy may include it at no extra charge at all. This is also the case with the contents of the hauler; a homeowner’s policy may just cover it. But you’ll want to contact your insurance agency to make sure of any coverage before heading out.

For more answers, you can always speak to your local Pace American trailer dealer.